Gambling Losses Deductions 2021

Have you ever wondered, can I deduct my gambling losses?

- Gambling Losses Deduction 2018 Irs

- How Much Gambling Losses Are Deductible

- Proof Of Gambling Losses Irs

- Gambling Losses Deduction 2019 Oklahoma

'Gambling losses are indeed tax deductible, but only to the extent of your winnings. This requires you to report all the money you win as taxable income on your return. However, the deduction for your losses is only available if you itemize your deductions. Miscellaneous Deductions. Gambling Losses to the Extent. These smart money moves can help ease tax burdens and boost tax refunds for a financially healthier 2021. Keeping a gambling diary, and specifically, tracking your gambling losses is a powerful tool in obtaining deductions of what you owe to the state or federal government at the end of the tax year. Therefore, many gamblers want to make sure they know how to prove gambling losses to the Internal Revenue Service (IRS) or any tax office around the. As an example, let’s say that in a given year you went gambling twice, winning $6,000 in one instance, but losing $8,000 in another. In this case, you can only deduct $6,000 from that $8,000 loss. Home mortgage interest. “The mortgage interest deduction is a common itemized deduction that.

You might be surprised to hear that the answer is yes. But you can only deduct gambling losses up to the amount of your winnings, and you must keep precise records.

You report gambling gains and losses in two separate places on the tax return.

- Report what you won as income on line 21 of the 1040.

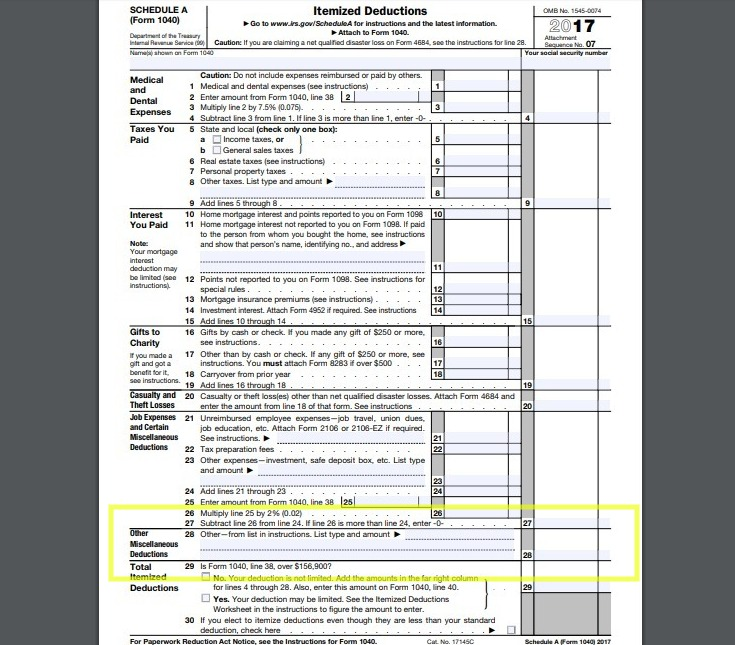

- Report what you lost as miscellaneous itemized deductions which are NOT subject to the 2% of AGI reduction on Schedule A.

Example

If you spent $300 purchasing lottery tickets and you had $200 in lottery winnings, you would enter $200 on Form 1040, line 21, and then enter only $200 as a miscellaneous itemized deduction on Schedule A—deducting just $200 of the $300 you spent on lottery tickets.

Gambling Losses Deduction 2018 Irs

Are you a Professional Gambler?

If you’re a non-professional gambler, you can report gambling losses only as a miscellaneous itemized deduction on Schedule A. But you do not have to reduce gambling losses by 2% of your adjusted gross income, as you must for many other miscellaneous itemized deductions.

If you’re a professional gambler (and we all want to know how a person becomes a professional gambler), the IRS seems to make this determination on a case-by-case basis. You can deduct gambling losses directly from your gambling income instead of deducting them as an itemized deduction on Schedule A.

Keep Records

Professional and nonprofessional gamblers alike need to keep adequate records to document their gambling losses. The records should include a diary of your gambling activities noting

- The date

- The location (name of the establishment and address)

- The names of other people who were there with you

- The amount you wagered

- The type of gambling

- Your winnings

- Your losses

You must also provide evidence of both what you won and what you lost. You can generally prove your winnings and losses through

- Form W–2G, Certain Gambling Winnings

- Form 5754, Statement by Persons Receiving Gambling Winnings

- Wagering tickets

- Canceled checks

- Credit records

- Bank withdrawals

Statements of actual winnings or payment slips provided by the gambling establishment

Other Deductible Losses

If you want to deduct losses from other gambling activities, you need documentation for those, too:

- Bingo: Record the number of games, ticket costs.

- Lottery: Keep records of ticket purchases, payment slips, and unredeemed tickets.

- Slot machines: Note the date, time, machine played, and machine number.

- Horse or dog races: Keep records of races and wagers.

How Much Gambling Losses Are Deductible

Related Articles:

The General Treasurer of Rhode Island is Seth Magaziner. When the state pays its bills, his signature (along with that of State Controller Peter Keenan) appears on the checks that are issued. Imagine the surprise when some business owners received tax refunds and instead of Mr. Magaziner’s signature, they looked down and saw “Mickey Mouse and Walt Disney.” Oops.

Proof Of Gambling Losses Irs

“As a result of a technical error in the Division of Taxation’s automated refund check printing system, approximately 176 checks with invalid signature lines were printed and mailed to taxpayers on Monday 7/27/2020. The invalid signature lines were incorrectly sourced from the Division’s test print files,” said Jade Borgeson, Chief of Staff for the [Rhode Island] Department of Revenue.

The checks were issued for business tax refunds, and impacted taxpayers are being contacted and presumably replacement checks are being issued.

Gambling Losses Deduction 2019 Oklahoma

On a more serious note, what should you do if you receive a tax refund you’re not due? I’ve had clients who receive such erroneous refunds. Do not cash the checks: If the money is not due to you, you’re not allowed to keep the funds. Contact the tax agency that sent you the refund, and follow their instructions to return the check.